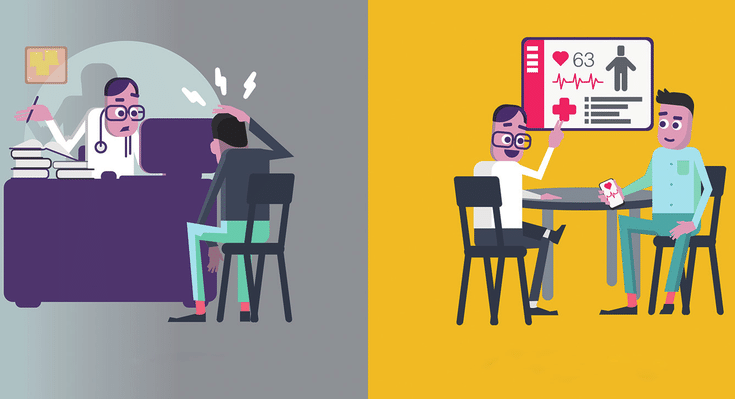

As the healthcare landscape evolves, so too do the ways we manage our health insurance. While traditional health insurance plans have long been the standard, digital-first health insurance models are rapidly gaining popularity, offering innovative and flexible options. But how do these two types of plans compare? And which one is right for you? In this article, we’ll explore the key differences between traditional and digital-first health insurance plans to help you make an informed decision.

1. Understanding Traditional Health Insurance Plans

What Are Traditional Health Insurance Plans?

Traditional health insurance plans are what most people are familiar with. These plans typically involve a monthly premium, with additional costs for doctor visits, hospital stays, prescription medications, and other healthcare services. Traditional plans are usually offered through employers, government programs (like Medicaid or Medicare), or private insurers.

Key Features of Traditional Plans

- In-person healthcare access: These plans generally require you to visit physical healthcare facilities for consultations, procedures, and prescriptions.

- Network-based coverage: Many traditional plans operate within a network of approved healthcare providers. You may be required to see in-network doctors and specialists to receive full benefits.

- Out-of-pocket expenses: Traditional plans often come with deductibles, co-pays, and coinsurance that patients must pay out-of-pocket before coverage kicks in.

Pros of Traditional Health Insurance Plans

- Established coverage: Traditional plans have a long history and are widely recognized and trusted.

- Comprehensive coverage: They tend to offer broader coverage for a variety of services, including in-person visits to specialists, hospitals, and urgent care centers.

- Familiarity and reliability: These plans are well-established, with predictable structures for billing, claims, and benefits.

Cons of Traditional Health Insurance Plans

- Limited flexibility: Traditional plans often require you to adhere to specific provider networks or geographical restrictions.

- Higher costs: Monthly premiums, deductibles, and co-pays can add up quickly, making traditional plans expensive for some individuals and families.

- Time-consuming: Scheduling appointments, waiting for in-person consultations, and dealing with paperwork can make accessing healthcare more time-consuming.

2. Understanding Digital-First Health Insurance Plans

What Are Digital-First Health Insurance Plans?

Digital-first health insurance plans are a newer model, leveraging technology to provide more flexible, efficient, and accessible healthcare. These plans are designed to prioritize digital healthcare services, such as telemedicine, digital health apps, and online prescription services. Many digital-first insurers operate on a subscription basis with low premiums and fewer in-person visits required.

Key Features of Digital-First Plans

- Telehealth and virtual care: Most digital-first plans focus heavily on virtual consultations with healthcare professionals, making it easy to get advice, diagnoses, and prescriptions online.

- Streamlined claims process: With fewer in-person visits, digital-first plans often have simplified, faster claims and billing systems, with more transparent cost structures.

- Tech integration: These plans often include access to health apps that track your fitness, monitor chronic conditions, or offer wellness advice tailored to your needs.

Pros of Digital-First Health Insurance Plans

- Convenience: Virtual consultations and online health management tools make healthcare more accessible, especially for individuals with busy schedules or those living in remote areas.

- Cost-effective: Digital-first plans often have lower premiums than traditional plans, making them a more affordable option for many people.

- Emphasis on preventative care: Digital-first plans often encourage a focus on wellness and prevention through apps and digital health monitoring tools, helping users stay healthier long-term.

- Faster service: With more digital interactions, you can get in touch with healthcare providers more quickly, without the need for long wait times or office visits.

Cons of Digital-First Health Insurance Plans

- Limited in-person care: While digital-first plans offer a lot of convenience, some individuals may prefer or require face-to-face consultations, particularly for complex health issues.

- Less comprehensive coverage: Digital-first plans may not cover as wide a range of healthcare services, such as surgeries or specialized treatments, as traditional plans.

- Technology reliance: These plans require access to the internet, smartphones, or computers, which may not be feasible for everyone.

3. Comparing Coverage: Traditional vs. Digital-First

Scope of Healthcare Coverage

- Traditional Plans: These plans offer comprehensive coverage, including access to in-person visits to specialists, hospitals, emergency rooms, and other healthcare facilities.

- Digital-First Plans: Coverage is usually focused on virtual consultations, mental health support, and routine healthcare services. Specialized treatments and emergency care may require additional coverage or be unavailable through digital-first models.

Flexibility and Access to Providers

- Traditional Plans: Access to a broad network of healthcare providers is often one of the main benefits of traditional health insurance. However, you may face limitations if you need to see out-of-network providers.

- Digital-First Plans: Digital-first plans offer flexibility through telehealth services, making it easier to access care from any location. However, there may be fewer options for in-person specialists or hospitals if you require more intensive treatment.

4. Cost Comparison: Which Option Is More Affordable?

Traditional Health Insurance Costs

Traditional health insurance often comes with higher premiums, deductibles, and out-of-pocket costs. Although these plans provide extensive coverage, they may not be the most budget-friendly option for individuals or families with limited healthcare needs.

Digital-First Health Insurance Costs

Digital-first plans typically have lower premiums and fewer out-of-pocket expenses. Since these plans rely on digital health services, the overall cost of care tends to be lower. However, you may need to pay extra for certain in-person treatments or services not included in the digital model.

5. Which Plan Is Right for You?

Consider Your Healthcare Needs

If you’re generally healthy, have limited healthcare needs, and value convenience, a digital-first health insurance plan may be a good fit. It’s an affordable and flexible option that provides easy access to virtual care. However, if you have ongoing medical issues that require in-person care or need specialized treatments, a traditional plan may be a better option for you.

Think About Your Tech Comfort Level

Digital-first plans require a certain level of comfort with technology. If you prefer speaking directly with doctors in person or if you don’t have reliable internet access, a traditional health insurance plan might be a more comfortable choice. However, if you’re tech-savvy and value the flexibility of digital health tools, a digital-first plan could be ideal.

Weigh the Costs and Benefits

Carefully consider the costs of both types of plans. While digital-first health insurance plans tend to be more affordable, ensure that the coverage meets your needs. If you anticipate needing a wide range of healthcare services, including in-person consultations and emergency care, a traditional health insurance plan might provide better value in the long run.

Conclusion: Finding the Right Health Insurance Plan for You

The choice between traditional and digital-first health insurance plans ultimately depends on your healthcare needs, lifestyle, and budget. Traditional plans offer extensive coverage, ideal for those who require regular in-person care or complex treatments. On the other hand, digital-first plans provide convenience, affordability, and access to virtual care, making them a strong option for healthy individuals who value flexibility.

Take the time to evaluate your unique health needs and preferences, and don’t hesitate to consult with insurance experts to find the right plan for you. Whether you choose a traditional or digital-first plan, the key is ensuring that your insurance aligns with your health goals and provides the coverage you need when it matters most.