Insurance premiums are the payments you make to keep your insurance coverage active. Whether it’s auto, health, life, or home insurance, your premiums can vary greatly depending on several factors. Understanding how these rates are determined can help you make informed decisions when purchasing or renewing an insurance policy. This article will explore the basics of insurance premiums and the key factors that affect your rates.

What is an Insurance Premium?

An insurance premium is the amount you pay for your insurance policy, typically on a monthly, quarterly, or annual basis. This payment allows you to maintain your coverage in case of an incident, such as a car accident or medical emergency. The premium you pay will depend on the type of insurance and the specific terms and conditions of your policy.

Key Factors That Affect Your Insurance Premiums

1. Type of Insurance Coverage

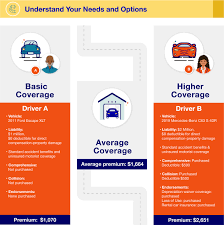

The kind of coverage you choose plays a significant role in determining your premium. For example:

- Auto Insurance: If you choose comprehensive coverage, your premiums will be higher than if you select basic liability coverage.

- Health Insurance: Plans with lower deductibles and broader networks often come with higher premiums.

- Homeowners Insurance: The level of coverage you select for your property, including additional riders or coverage for valuable items, can impact your premium.

The more coverage you have, the higher your premiums are likely to be. It’s important to assess your specific needs when choosing a policy to ensure you have the right coverage at an affordable price.

2. Your Age

Age can significantly influence your insurance premiums, particularly for auto and health insurance.

- Auto Insurance: Younger drivers, especially those under 25, typically pay higher premiums because they are statistically more likely to be involved in accidents. As drivers gain experience and maintain a clean driving record, their premiums often decrease.

- Health Insurance: Premiums generally increase as you get older. Older individuals face higher health risks, which translates to higher premiums. This is why health insurance for seniors tends to be more expensive than for younger individuals.

3. Your Driving Record (for Auto Insurance)

For auto insurance, your driving history is a key factor in determining your premium. Insurers will review factors such as:

- Traffic Violations: Speeding tickets or running red lights can cause a spike in premiums.

- Accidents: If you’ve been involved in accidents, even if they weren’t your fault, your premiums may increase due to the perceived higher risk of future claims.

- DUI/DWI Convictions: A driving under the influence conviction will lead to significantly higher premiums or even difficulty obtaining coverage.

Drivers with a clean record will generally enjoy lower premiums, while those with a history of violations or accidents may face much higher rates.

4. Your Credit Score

In many regions, insurers use your credit score as a measure of financial responsibility. A higher credit score generally means lower premiums, as insurers view individuals with better credit scores as less likely to file a claim.

- Better Credit: If you maintain a solid credit score, you may be eligible for lower rates.

- Poor Credit: Individuals with lower credit scores often face higher premiums because they are seen as a higher risk to insurers.

Improving your credit score can be an effective way to reduce your insurance costs in the long run.

5. Location

Where you live can also affect your insurance premiums. Insurance companies use location-based data to assess the level of risk associated with providing coverage in a particular area. Factors include:

- Crime Rates: If you live in an area with a high incidence of theft, vandalism, or other crimes, you may face higher homeowners or auto insurance premiums.

- Weather and Natural Disasters: Regions prone to natural disasters, such as hurricanes or earthquakes, typically have higher premiums for homeowners and renters insurance due to the increased likelihood of claims.

- Traffic Density: For auto insurance, living in a densely populated city or an area with heavy traffic can increase the likelihood of accidents, leading to higher premiums.

6. The Amount of Deductible

Your deductible is the amount you agree to pay out-of-pocket in the event of a claim before the insurer steps in to cover the rest. Generally, the higher your deductible, the lower your insurance premium will be.

- Higher Deductible: If you choose a higher deductible, you assume more of the financial burden in case of an incident. Insurance companies reward you for taking on more risk with lower premiums.

- Lower Deductible: If you opt for a lower deductible, your premiums will increase because the insurer will cover a larger portion of your claim costs.

Balancing your deductible with your ability to pay out-of-pocket expenses is important when selecting the right plan for you.

7. Claims History

If you have filed multiple claims in the past, insurers may consider you a higher risk, which could lead to increased premiums. This is especially true for auto and home insurance. Insurers generally offer lower rates to policyholders who have a history of few or no claims, as they are less likely to cause the insurer to pay out large amounts.

For example:

- Homeowners Insurance: If you’ve filed several claims for property damage or loss, insurers may raise your premiums due to the perceived risk of future claims.

- Auto Insurance: Multiple claims, such as accidents or theft, could make it harder to find affordable coverage.

8. The Insurer’s Underwriting Criteria

Different insurers have different approaches to underwriting. An insurance company might evaluate your risk based on their own criteria, which can lead to variations in premiums across different providers. Some insurers may weigh certain factors more heavily, such as your driving history, while others may prioritize credit scores or your location.

It’s a good idea to shop around and compare quotes from multiple insurance companies to ensure you’re getting the best possible rate for the coverage you need.

Tips to Lower Your Insurance Premiums

1. Maintain a Clean Driving Record

For auto insurance, avoiding traffic violations and accidents is one of the best ways to keep your premiums low. Taking defensive driving courses can sometimes help reduce premiums as well.

2. Bundle Your Policies

Many insurers offer discounts for bundling multiple types of insurance, such as home and auto coverage. This can help you save money on your premiums while maintaining comprehensive coverage.

3. Increase Your Deductible

As mentioned earlier, opting for a higher deductible can help lower your premiums. However, make sure you can comfortably afford the deductible amount if you need to file a claim.

4. Improve Your Credit Score

A higher credit score can lead to lower premiums, so it’s worth taking steps to improve your credit by paying off debts, avoiding late payments, and monitoring your credit report.

5. Shop Around

Different insurance providers have different pricing structures, so shopping around for the best deal is key. Take the time to get quotes from multiple insurers and evaluate their coverage options and customer service before making a decision.

Conclusion

Understanding the factors that influence your insurance premiums can help you make smarter choices when purchasing or renewing your policies. From your age and driving record to your location and credit score, these elements all play a role in determining how much you’ll pay for coverage. By being proactive in managing these factors, you can find ways to reduce your premiums without sacrificing the coverage you need. Always remember to shop around and compare quotes to ensure you’re getting the best value for your money.